SILVER PRODUCTION

Global mined silver production fell marginally in 2022, by 0.6% y/y to 822.4Moz (25,578t). This followed strong growth of 5.8% the previous year as mines recovered from the disruption caused by COVID. Output in 2022 was 20.8Moz (648t) lower than our forecast in last year’s World Silver Survey as several major new projects were delayed; Buenaventura’s Uchucchacua did not resume production as had been anticipated, while several other mines were impacted by unexpected disruptions.

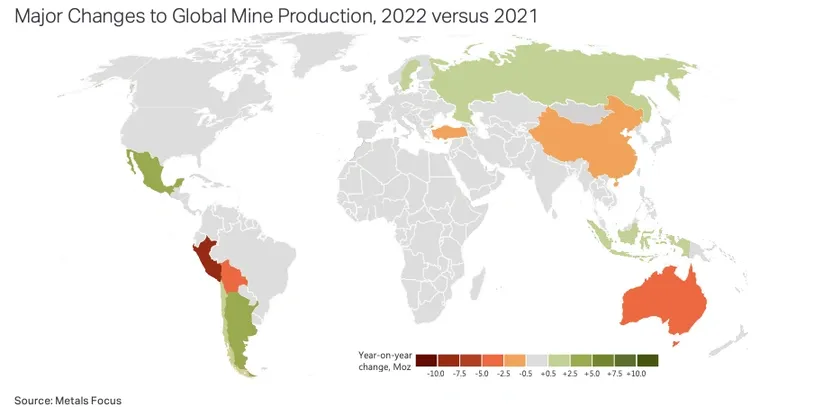

Last year’s drop in global silver production was driven by lower by-product output from lead/zinc mines (-3.5%). This was partially offset by higher silver production from gold (+1.0%) and copper (+0.8%) mines. Meanwhile, output from primary silver mines was almost flat year-on-year (+0.1%). At the country level, Peruvian output fell by the most (-8.5Moz, 263t), followed by Australia (-4.2Moz, 131t) and Bolivia (-2.8Moz, 88t). These losses were partially offset by rising output from Mexico (+3.1Moz, 98t), Argentina (+3.0Moz, 94t) and Russia (+2.2Moz, 67t).

This year, we expect mined silver supply to rise by 2.4% y/y to 842.1Moz (26,193t). This will largely be due to additions from new projects. Juanicipio, for example, is expected to reach full capacity in H1.23 and this will be a major driver of growth in Mexico. Elsewhere, the continued ramp-up of La Coipa and commissioning of Salares Norte will push Chilean output higher. Our forecast also assumes Uchucchacua resuming production towards the end of 2023.Survey 2023.

Source: The Silver Institute and Materials Focus